How to Read & Analyze Crypto Tokenomics (In a Nutshell)

When buying anything other than dog coins, you must carefully inspect a project’s tokenomics. Tokenomics lay out the structure of a cryptocurrency and provides details regarding several quantitative and qualitative factors.

Tokenomics answers questions such as:

- What is the token supply?

- How was the token distributed?

- How do tokenomics affect utility?

- What incentives do holders have?

The term tokenomics was created as a combination of the words ‘token’ and ‘economy.’ Researching tokenomics is a crucial step to conducting fundamental analysis (FA). A project with good tokenomics denotes sustainability and longevity.

Today’s post explains why tokenomics form the backbone of a project’s investing thesis. But before we go any further with the technicals, let’s take a look at tokenomics from the lenses of the first cryptocurrency: Bitcoin.

Bitcoin: A Classic Example of Good Tokenomics

Bitcoin’s tokenomics are rather simple.

The project has a maximum token supply of 21 million coins. The Bitcoin network generates these coins through the act of mining. Mining involves dedicating computing power to the network in order to put incoming transactions into a transaction block. This is the equivalent of logging transactions into a decentralized ledger.

A transaction block yields 6.25 BTC, which is evenly distributed to miners based on their contributed power.

A new block is mined approximately every 10 minutes. And every 210,000 blocks, the Bitcoin network halves block rewards. This leads to a halving which takes place every four years.

Halving reduces inflation. This means that fewer coins enter Bitcoin’s circulating supply as more coins are mined. This has a positive impact on Bitcoin’s price due to the laws of supply and demand.

What are the incentives here? Users want to send funds over an anonymous, decentralized, and public payment network. For a user to send a transaction, he must pay a fee to the miner — who will log his transaction into the blockchain. The fees, along with block rewards, incentivize miners to support the network and push new transactions.

Growing network activity and block halvings are what incentivize holders and speculators to invest in Bitcoin. The more transactions there are, the merrier!

Key Factors Behind Tokenomics

Compare tokenomics to the budget of a newly-formed government. The budget dictates how much money the government distributes to different branches of the economy and incentivizes consumers to spend their salaries on certain goods. The budget also invests in the country’s infrastructure and creates incentives for workers to seek employment in certain industries.

In this example, developers represent the government, tokenomics represent the budget, and tokens represent the currency. Developers create a token with a certain supply and distribute it to the project.

Token Supply

Every cryptocurrency must have a token supply. The most important metric relevant for supply is the maximum token supply — also known as hard cap.

A maximum token supply dictates how many tokens can ever exist. Bitcoin has a maximum supply of 21 million coins, and it will never exceed that number. This metric is hard coded into the project and cannot be changed.

Note that not all cryptocurrencies have a hard cap. Notable examples include Ethereum, USDT, and USDC. ETH’s supply is unlimited in its PoW version. Stablecoins don’t have a maximum supply because tokens are issued based on internal fiat reserves.

The next metric is circulating supply. Circulating supply represents the number of tokens circulating in a market at any given moment. Bitcoin has a circulating supply of 19,124,681 coins. This means that 1,875,319 more coins are yet to be mined and enter the market.

In terms of fundamental analysis, token supply can provide you with valuable knowledge regarding a token’s value. It’s extremely difficult for a token with a large supply to reach a high dollar value. That’s because it takes more money to increase the value of a cryptocurrency.

And if you use market capitalization, you can easily calculate price targets and determine how realistic they are. You calculate the market cap by multiplying the circulating supply with the current price.

Market cap = Price * circulating supply

For example, this formula tells us that Bitcoin has a market cap of $449,613,192,018. Now go ahead and multiply your price targets for an altcoin with their circulating supply to determine how realistic the market cap is compared to Bitcoin.

Token Distribution

Token distribution is the next key factor (from a FA perspective). This metric tell you how the token has been distributed to investors.

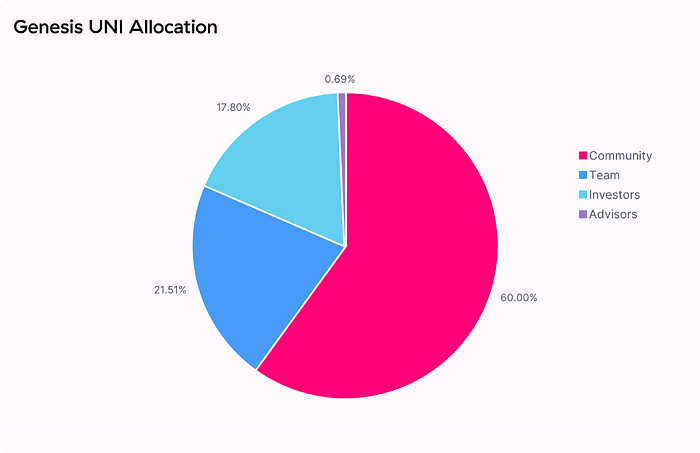

In the example above we have UNI, a governance token for the Uniswap decentralized exchange. The distribution went like this:

- 60% went to the community (people who swapped tokens prior to airdrop).

- 21.51% went to the team (paying employees, marketing, funding servers, etc.).

- 17.8% went to investors (VCs and angel investors who funded Uniswap prior to launch).

- 0.69% went to advisors (blockchain experts who support the team).

Token distributions tells you how much of the token supply each group holds. This knowledge is great for determining sources of selling pressure. For example, VC or ICO investors with unvested holdings can dump large numbers of tokens onto the market after the token’s listing on an exchange.

If these funds are vested — meaning that they are released in several small portions according to a set schedule — you can determine when these waves of large selling pressure can take place.

Detailed token distribution for the project itself can also provide you with valuable insight into the project’s longevity and potential. If the team allocates a larger percentage of tokens to marketing than development, you can tell that the project likely lacks a real use case beyond driving hype.

Token Utility

A token’s utility plays a large part in tokenomics. Utility determines use case, hard cap, monthly emissions, and many other things. When you combine factors such as distribution and supply, you can tell how healthy the tokenomics are.

Let’s use an imaginary project that seeks to reward users as an example. Maybe this is a staking or yield farming protocol that rewards users through interest — distributed via a native token. Let’s also say that the project hands out 100 tokens per day to every user and has a hard cap of 1 million.

If 1,000 users participate in the ecosystem, the project will already distribute 100,000 tokens on day one. By the end of day 10, the project will distribute all of its tokens, and there won’t be any rewards left for future investors.

This is an example of poor tokenomics. The project must either have a larger maximum token supply or decreased rewards.

Here’s a question for you: should a token used to pay gas fees have a high or low token supply?

The answer is high token supply! The token’s utility is to pay for transaction fees. If the network is highly active but doesn’t emit enough tokens, you run the risk of paying high fees (or having to buy the gas token off secondary markets).

Token Incentives

Token incentives tie in with utility. Token incentives are meant to attract users to the network through rewards. For a larger portion of crypto history, incentives have been carried out using Proof of Work networks: a user supports the network and confirms transactiosn by contributing computing power.

The arrival of Proof of Stake — a model in which validators replace miners — brought a new incentive: users securing the network by locking tokens into the network in return for receiving tokens during the lockup as a reward.

Ethereum’s transition to PoS means that people will no longer mine but stake Ethereum. They will deposit 32 ETH into the network and receive an annual yield ranging between 5% to 10%. Securing the network means preventing 3rd-parties from gaining too much control over the token’s supply (51% attacks).

In DeFi, protocols reward investors for providing cryptocurrencies as collateral. They receive a governance token in return which they can sell. Alternatively, they can vote on proposals that improve the protocol and ensure long-term sustainability.

How to Analyze Crypto Tokenomics

Analyzing tokenomics is a three-step process.

The first step is to collect relevant token data for a cryptocurrency. You can find all the information you need on a project’s official website. The most important information is often found inside the whitepaper. You can also use websites such as CoinMarketCap and CoinGecko to quickly find data for:

- Market cap

- Price

- Contract address

- Contact info

- Circulating Supply

- Max supply

The second step is to analyze the tokenomics report. Take a look at metrics such as token distribution, emissions, vesting schedules, and other valuable metrics.

Investigate the token’s utility and deduct whether it can amass any real value from network activity. Figure out whether the token is any good, and if so, head over to the third and final step.

The third step is to compare the project’s tokenomics to those of similar projects targeting the same use case.

For example, you might want to compare the reports of governance tokens from two or more DeFi lending protocols. See how they match up and whether one of the two offers better fundamentals.

How Important is Tokenomics for FA?

Tokenomics are extremely important. However, should they be the decisive factor when investing?

Analyzing tokenomics plays only one small role in conducting fundamental analysis. While healthy tokenomics matter, they shouldn’t be the sole factor that influences your investing decisions. You need to consider other important aspects such as the use case, competing protocols, potential adoption rate, roadmaps, etc.

Tokenomics have a high impact on a token’s success, however, they don’t make or break a project. Nevertheless, knowing how to read and analyze tokenomics is still a great skill to have as an investor. Who knows? It might help you find the next 100x.

About us

Shrimpy is an automated portfolio management platform that helps cryptocurrency investors manage their capital through the use of a simple and intuitive app that saves time and money with the power of automation.

To find out more about our platform and discover how it can jumpstart your crypto journey, feel free to visit our main website.

We also provide free blockchain education to the masses at the Shrimpy Academy and Youtube.